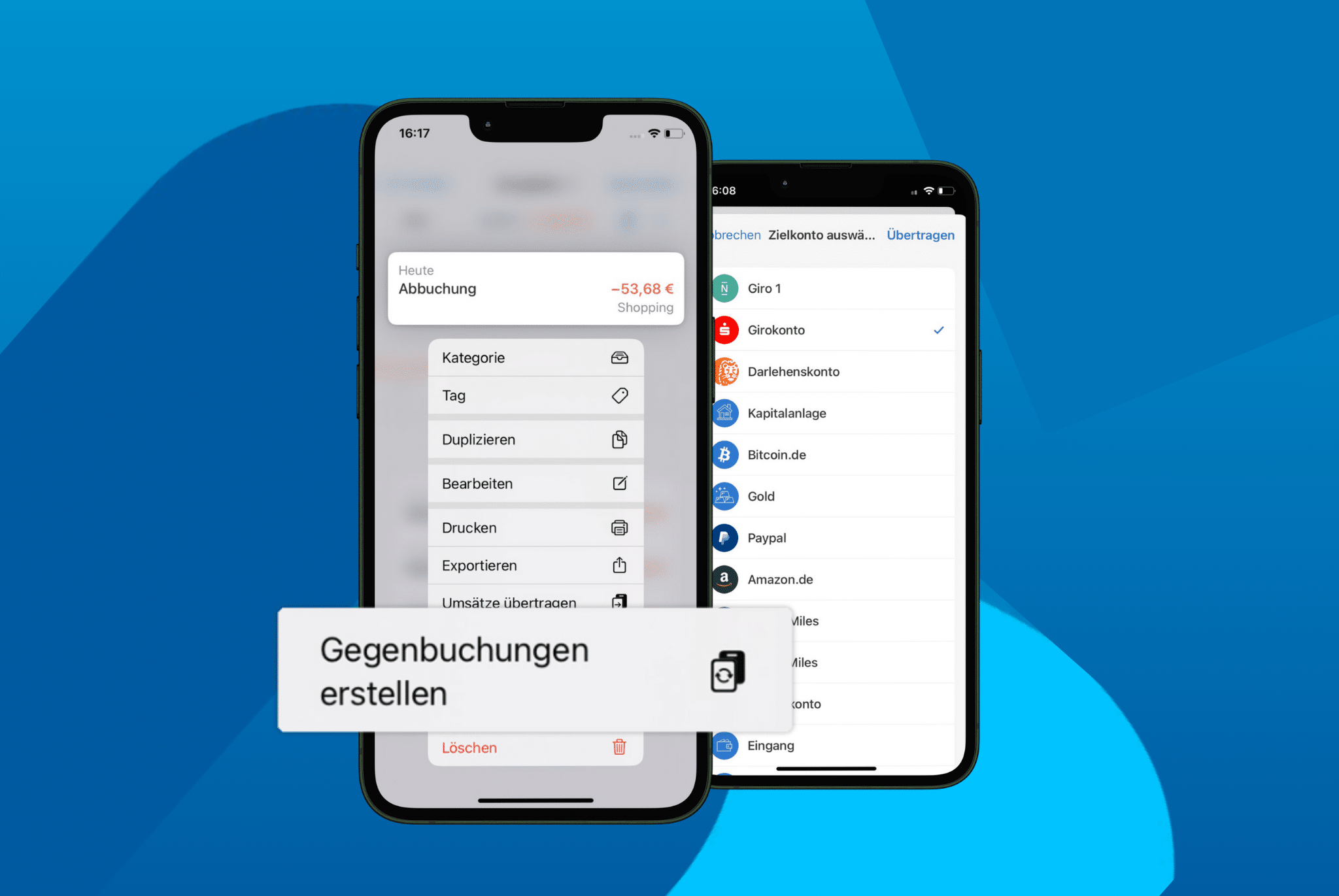

Gegenbuchungen jetzt in Outbank!

Mit dem neusten Update 3.12.3 führen wir für euch die lang erwartete Option der Gegenbuchung ein. Diese könnt ihr ganz einfach, mit nur einem Fingertipp ausführen. Wofür Gegenbuchungen? Vielleicht fragt ihr euch jetzt, wofür Gegenbuchungen überhaupt gut sind. Deswegen zeigen wir euch hier zwei einfache Anwendungsbeispiele: Beispiel 1: Bargeldabhebungen